best books on canadian taxes

Maybe not be relevant. The 2019-2020 Edition of BuckwoldKitunenRoman maintains its highly readable student friendly format and full.

Amazon Ca Best Sellers The Most Popular Items In Taxation

Posted by 5 years ago.

. Prices may change without notice. Chris BaxterRental Property Investor from Port Coquitlam BC. This is without a doubt the best book for the Canadian real estate investor to start with.

Canadian Income Tax Law 6th Edition. But most look to be several years old now. Did a little looking around and have some in mind.

This edition is dedicated to Peter Hogg who created this book and continues to inspire us. Master Your Mortgage for Financial Freedom. 45 out of 5 stars.

Making Money in Real Estate Gray. Make Sure Its Deductible. Commercial Real Estate Investing in.

Little-Known Tax Tips for Your Canadian Small Business Fifth Edition. Best books on how to manipulate the Canadian tax system. A whopping 91 of Canadians who filed tax returns in 2021 did so by using electronic filling methods.

I have always filed my own taxes but I doubt I have taken advantage of all the possible. Like the title says. Best and most current Canadian tax book.

To fill the void BDO Canada LLP and Gowling WLG have co-written the fifth edition of Taxation of Private Corporations and Their Shareholders the flagship publication of the Canadian Tax Foundation which analyzes the tremendous changes affecting private corporations over the past few years. Byrd Chens Canadian Tax Principles 2021-2022 Edition Volumes I and II with Study Guide Book. Its got all the basics and enough to get you started.

8 offers from 2045. Just as bridges connect parts of Canada together Canadian Income Taxation. Of these 326 used a tax software approved by the CRA for NETFILE 582 used an EFILE service and 02 of filers used File My Return.

Retirement Income for Life. Add to cart. This free online tax software allows you to handle all tax scenarios and give you the confidence to file with accuracy and security.

Deep dive into company structures tax planning and accounting for REI. Legal Tax and Accounting Strategies for the Canadian Real Estate Investor Cohen Dube. Real Estate Investing in Canada.

Planning and Decision Making connects tax law and its application to business and investment transactions and decision making. HR Block has an online tax system that allows Canadians to file their own tax returns. I am about to own a house in a few months one we bought October 2015 S and I want to know everything there is about taxes in Canada.

The platform also provides expert help to those that need it. Best Sellers in Small Business Taxes. A complete guide for Canadian investors.

This book is the primary resource for private. Duff Author Benjamin Alarie Author Geoffrey Loomer Author Lisa Philipps Author. It is the only real estate specific book that I had read when I bought my first rental property.

5 HR Block. Creating Wealth with the Acre System Don Campbell. Getting More without Saving More Second Edition 116.

Byrd Chens Canadian Tax Principles 2021-2022 Edition Volumes I and II with Study Guide Book Standing Order. Anyone have any recommendations on Canadian tax law books. Byrd Chens Canadian Tax Principles 2020-2021 Edition can be used with or without other source materials this includes the Income Tax Act Income Tax Folios and other official materialsThe Income Tax Act is referenced in the text where appropriate for further.

Principles of Canadian Income Tax Law is an introduction to Canadian income tax law using clear concise and non-technical language. Looking for a good read with the most current information. This work provides an overview of the foundations of tax law and the critical cases which have shaped each component of the tax regime uniquely combining the best features of both a textbook and casebook.

How to Use The Smith Manoeuvre in Canada to Make Your Mortgage Tax-Deductible and Create Wealth. It carries forward Peters commitment to precision and clarity in his enthusiasm for the public law. Best and most current Canadian tax book.

Written in an accessible style this text assumes that the student has no previous education in taxation. The best tax software in Canada helps you maximize your refund and many even allow you to file your taxes online for free.

How To Prepare And File Your Canadian Tax Return Dummies

Amazon Ca Best Sellers The Most Popular Items In Taxation

Byrd Chen S Canadian Tax Principles 2020 2021

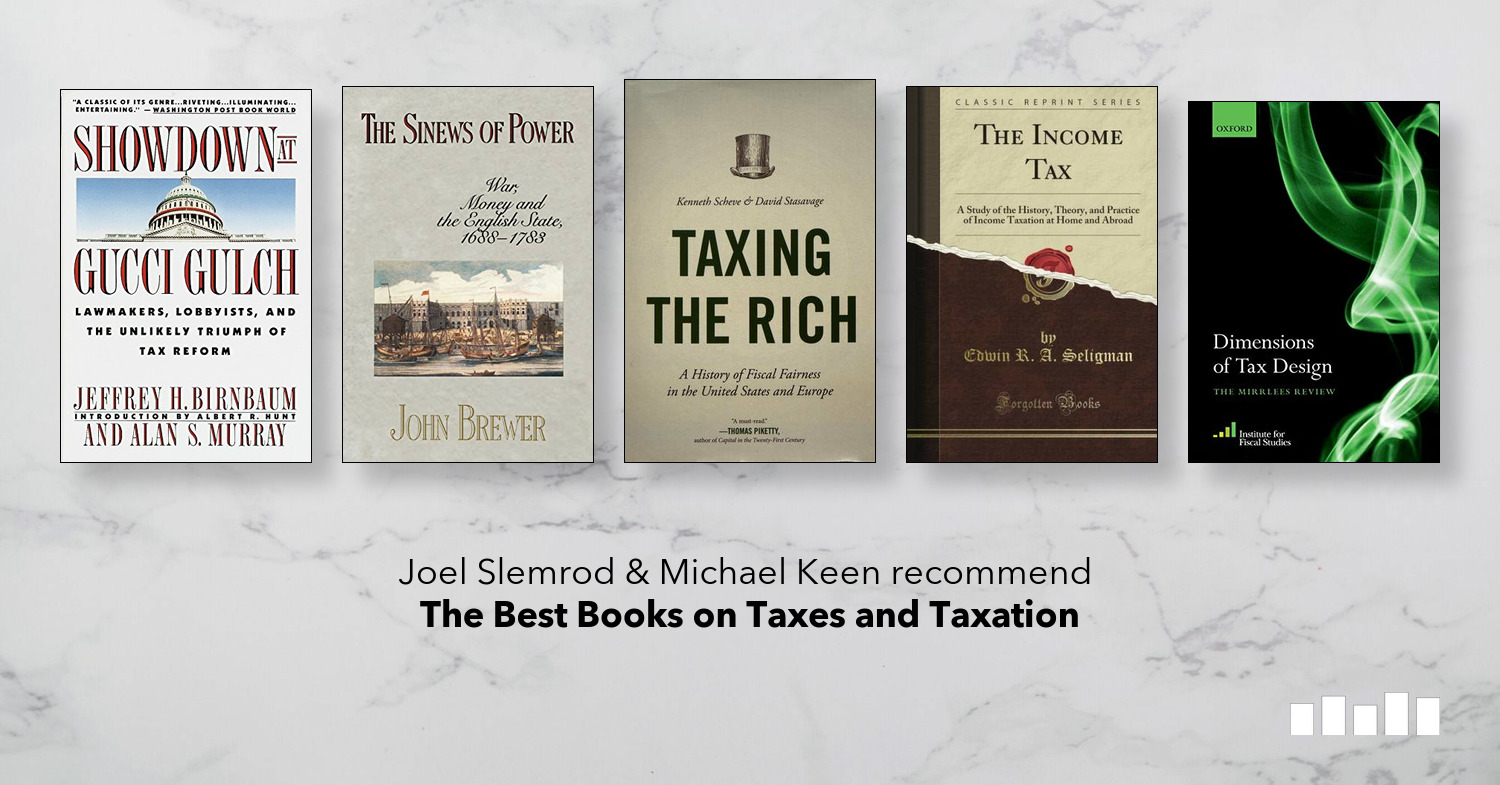

The Best Books On Tax Five Books Expert Recommendations

6 Canadian Personal Finance Blogs To Follow In 2022 Genymoney Ca Personal Finance Blogs Finance Blog Personal Finance Lessons

Where Your Tax Dollar Goes Cbc News

The Essential Canadian Guide To Estate Planning 2nd Edition A Journey Towards Peace Of Mind Wark Kevin 9780993672484 Books Amazon Ca

The Best Books On Tax Five Books Expert Recommendations

Awesome Website Inspiration From Land Book Com Website Inspiration Website Design Inspiration Web Design Gallery

Amazon Ca Best Sellers The Most Popular Items In Taxation

Amazon Ca Best Sellers The Most Popular Items In Taxation

Ubc Press Give And Take The Citizen Taxpayer And The Rise Of Canadian Democracy By Shirley Tillotson

Amazon Ca Best Sellers The Most Popular Items In Taxation

Bookkeeping For Canadians For Dummies By Lita Epstein Http Www Amazon Ca Dp 1118478088 Ref Cm Sw Bookkeeping Bookkeeping Business Small Business Bookkeeping